-

Welcome to Tacoma World!

You are currently viewing as a guest! To get full-access, you need to register for a FREE account.

As a registered member, you’ll be able to:- Participate in all Tacoma discussion topics

- Communicate privately with other Tacoma owners from around the world

- Post your own photos in our Members Gallery

- Access all special features of the site

Money modding or paying off the taco.

Discussion in '2nd Gen. Tacomas (2005-2015)' started by kpla51, Jan 16, 2015.

Page 2 of 4

Page 2 of 4

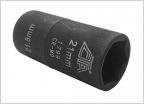

I got a case of the swollen nuts.

I got a case of the swollen nuts. Oem Bed extender

Oem Bed extender Wiper Arm Removal

Wiper Arm Removal Cabin Filter-Cheap replacement

Cabin Filter-Cheap replacement Manual Transmission Fluid Change?

Manual Transmission Fluid Change? Serp belt and pulleys

Serp belt and pulleys