-

Welcome to Tacoma World!

You are currently viewing as a guest! To get full-access, you need to register for a FREE account.

As a registered member, you’ll be able to:- Participate in all Tacoma discussion topics

- Communicate privately with other Tacoma owners from around the world

- Post your own photos in our Members Gallery

- Access all special features of the site

Toyota Financial Tricky Payment?

Discussion in '2nd Gen. Tacomas (2005-2015)' started by NJ92783, May 10, 2010.

Page 3 of 4

Page 3 of 4

Hawk Brake Pads LTS .665 vs .685 Thickness

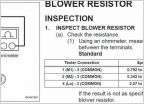

Hawk Brake Pads LTS .665 vs .685 Thickness Fan Blower Resistor...again...

Fan Blower Resistor...again... Pop and Lock Tailgate Lock Questions

Pop and Lock Tailgate Lock Questions 2nd Gen Headlights w/ DRL

2nd Gen Headlights w/ DRL Dual Exhaust

Dual Exhaust 2.7 Spark plug locations

2.7 Spark plug locations