-

Welcome to Tacoma World!

You are currently viewing as a guest! To get full-access, you need to register for a FREE account.

As a registered member, you’ll be able to:- Participate in all Tacoma discussion topics

- Communicate privately with other Tacoma owners from around the world

- Post your own photos in our Members Gallery

- Access all special features of the site

Any advice on shopping vehicle insurance rates?

Discussion in 'General Tacoma Talk' started by dangeroso, Jun 10, 2024.

Page 1 of 3

Page 1 of 3

My bed security solution

My bed security solution Bullbar

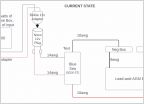

Bullbar Male seeking Advice - Electrical Wattage Loss Issues and Potential Solutions

Male seeking Advice - Electrical Wattage Loss Issues and Potential Solutions Rodents chewed up engine harness!

Rodents chewed up engine harness! What emergency tire plug kit do you all carry on the truck

What emergency tire plug kit do you all carry on the truck